How Our Clients

Are Leading The Change.

We have helped 600+ companies accelerate their business with top-notch marketing solutions.

All Our Results.

56.25% increase in conversions, 41.27% lower CPC, and doubled call volume with reduced spend through focused campaigns

150% increase in conversions, 62% decrease in cost per conversion, and 206% higher conversion rate for WW Displays.

ROAS doubled from 1.8 to 3.7 and CTR increased by 24.80% through multi-channel optimization across search and social

Improved tracking cut CPL to $28 and boosted lead volume for Witch’s Rock Surf Camp.

Valet Living needed a PPC agency with a proven track record to improve PPC performance fast.

US Mortgage Corporation tasked us with enhancing their PPC campaigns focusing on their 203K Home Renovation Loans.

Tint My Ride needed a PPC expert. We optimized Google and Meta Ads, boosting leads and visibility for tinting services.

Targeted Paid Search drove a 48% boost in new customer purchases and an 86% increase in revenue for The Nail Hub.

Tanner Tees was seeking greater visibility for their products in the shopping feed on the Google Shopping Network.

Tactical Junkie reached out to Black Propeller to grow their existing PPC campaigns and SEO marketing.

With a proven lead generation strategy, STISD has been able to secure a larger marketing budget and growth plan.

Black Propeller identified the root cause of Shade Pro's PPC challenges and developed a plan to course correct.

Black Propellar utilizes an omni-channel Social Advertising Strategy to boosts Sedano's Supermarket sales.

The client aimed for a $250 CPA in all five markets, requiring a 42% reduction in CPL to meet this goal.

Sam Karam and Sons came to Black Propeller looking to test digital advertising as a new lead source.

Our comprehensive approach highlights the outstanding results achieved through our PPC management services.

Retirement Planners of America Witnesses Never-Before-Seen Lead Growth from PPC

Conversion rate increased by 74%, from 5.94% to 10.4%, with a 99.85% confidence score after optimizing landing page form

178% increase in ROAS reaching 7.8 total ROAS through targeted Performance Max campaigns

A single headline change lifted conversions from 2% to 12.96%, yielding a 548% boost and higher quality leads.

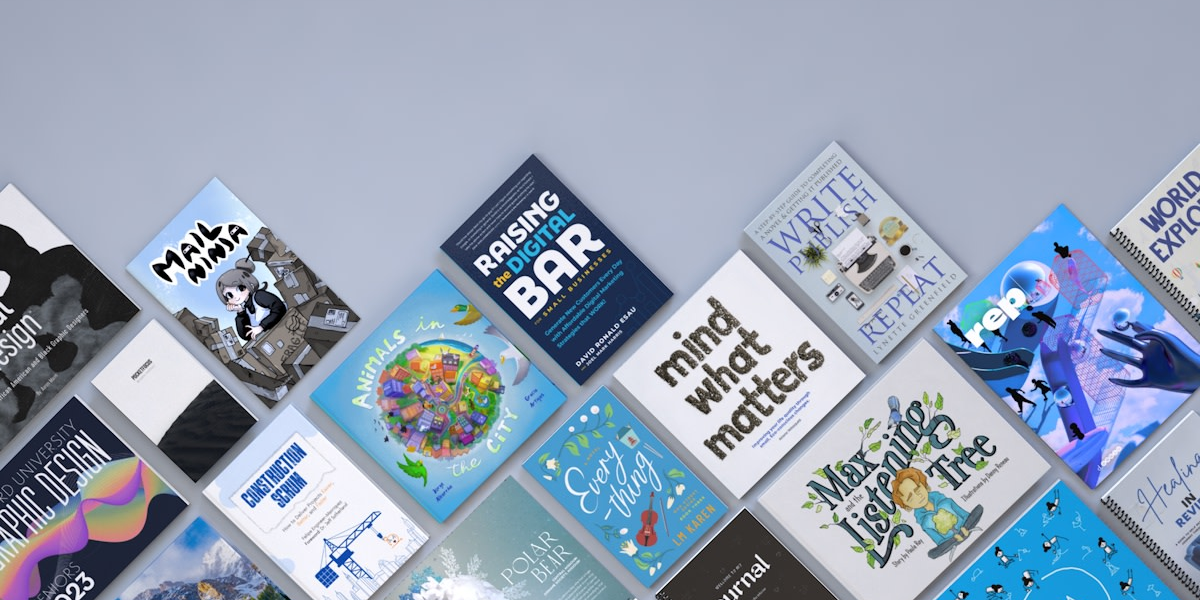

Page Publishing sought to overhaul Google and Microsoft Ads, targeting US leads and expanding campaigns internationally.

Optimized campaigns drove a 216% purchase surge, 61% lower CPA, and a 270% revenue jump for Outdoors For Less.

Outdoor Solar Store came to us looking to get back on track and increase ROAS after a year of declining profits.

OPS Security Group sought Black Propeller to boost lead quality and quantity, aiming to drive more closed deals via PPC.

Our primary goals were to optimize the PPC account for effective results, transparent metrics, and a CPC of $150.

Olde Wood Limited approached us with its goals of increasing leads and revenue through paid advertising.

NRG Clean Power gained profitable deals, amplified revenue, and strengthened their foothold in the solar market.

Achieved 800% ROAS, improved lead routing, and streamlined Google Ads attribution for Norfolk Kitchen & Bath.

Their goal was to organize campaigns, update landing pages, update creative assets, and drive qualified leads.

MyHotTub approached us with the goal of boosting their sales and establishing a consistent and effective PPC strategy.

Custom tracking revealed Facebook drives lower CPL leads while Instagram secures more booked consultations.

In 2022, we set out to increase MISSHA's brand recognition and prove success advertising on Facebook and Instagram.

Microscope Central sought out the expertise of Black Propeller to blast through a PPC plateau.

Our goal was to optimize both PPC and SEO efforts to attract high-quality traffic and reduce the cost per lead.

Mass Firearms School partnered with Black Propeller to increase course sign-ups while keeping cost-per-conversion low.

Lulu Press approached our team to enhance their digital ad strategy and drive increased registrations on their website.

45% revenue growth, 80% ROAS improvement, and optimized targeting for Louped's luxury resale marketplace in just 60 days

Journeys Holistic Life came to Black Propeller struggling to maintain profitability.

With strategic execution, we quickly achieved the PPC magic triangle: higher CTR, increased CVR, and lower CPC.

Black Propeller helps Happy Jack increase traffic to their retailers’ online storefronts and physical stores.

Black Propeller's strategic Performance Max campaign produces higher CVR & sales for GunSafes.Com.

36.87% increase in revenue and 30.26% more purchases by strategically splitting large product feed campaigns

Falcon Car Rental turned to Black Propeller to steer their Google Ads account towards a $100K/month revenue.

Embrace Pet Insurance sought our services to scale policy purchases, cut costs, + boost non-brand campaign efficiency.

Our goals were to revitalize outdated campaigns, cut unqualified clicks, and boost performance across top 3 services.

Significant CPA reduction to $11.69 in Montreal and $29.39 in Toronto through targeted SKAG campaigns

CUBE 84 reached out to us at Black Propeller knowing we would deliver a positive return on their PPC investment.

Construct Capital trusted Black Propeller to take their PPC and SEO performance to new heights.

Black Propeller identified the opportunity to scale sales by expanding into new marketplaces.

Over 2 years, Black Propeller scaled Base Camp Leasing's leads for record-breaking performance.

Optimized Paid Search generated 15 inquiries in month 1, with over 50% converting to booked calls for BALANCE.

Avertium sought to grow its client base + boost lead quality, targeting mid-to-enterprise firms in specific industries.

Paid Search optimizations drove a 200% rise in searches, 5 extra Gold IRA conversions, and a $19 CPA on core keywords.

AROCON Roofing saw phenomenal year over year growth across multiple areas of their business with Black Propeller.

AHLA sees their best year yet from our longstanding partnership and multifaceted PPC strategy.

Active Skin Repair achieved a 36% ROAS lift, 17.5% lower CPA, and 12% higher AOV with our Paid Search & Social strategie